Afterwards, you just need to lay feet in the Panama to possess 24h just after all the two years to save the newest abode effective. That isn’t difficult more so you can instantaneously receive long lasting abode from Panama Friendly Regions charge. You first begin by two years away from temporary abode, and you will immediately after two years you could move it to help you long lasting residence. Hasn’t participated in a keen eviction diversion system within the last 1 year. The newest landlord can get perform the repair, replacement, or cleanup otherwise will get participate a third party to do so.

However, a residence managed from the an entire-go out pupil enrolled during the an institution away from degree within the an enthusiastic undergraduate degree system ultimately causing a good baccalaureate degree and you can occupied by the the newest college student when you’re going to the school isn’t a long-term place from residence regarding you to definitely college student. To find out more, find TSB-M-09(15)We, Modification on the Definition of Permanent Host to Abode in the Personal Income tax Laws Per Specific Student Pupils. For many who or the qualified college student says a federal deduction otherwise credit to own certified college tuition costs, you can nevertheless make use of these expenses to determine the institution university fees itemized deduction. Complete so it plan if you noted the new Sure package during the product H to the Setting It-203.

- PayPal isn’t available in certain parts of the world to own deposit in the casino internet sites, but it is probably one of the most utilized options from the United Kingdom.

- The newest state out of also have up coming decides whether or not companies need charge the new HST, and when thus, at which speed.

- One which just discover a merchant account which have a cards partnership, find out when they NCUA-insured.

Go into the total number out of months you did perhaps not work since the away from illness during this period out of a job. Go into the total number from holidays (such Xmas, Thanksgiving, otherwise Columbus Date) perhaps not worked during this time away from a job. Go into the final amount of Saturdays and Sundays maybe not did throughout the this era away from employment. Using the more than beliefs, normal functions weeks spent at home are believed days worked in the Nyc State, and you can weeks invested a home based job which aren’t normal work weeks are thought getting nonworking months. Less than which rule, weeks worked at home are considered Nyc functions months only in case your employee’s assigned or primary work location was at a reliable work environment and other real office of your own company (a genuine workplace workplace) in the Ny Condition. If your employee’s assigned otherwise first work area was at a reputable place of work or any other genuine office of your company outside New york County, following people regular work day worked in the home will be addressed because the twenty four hours has worked external Ny State.

Import extent from Function It-203-ATT, range 33 Net other Ny State taxes, to line forty two. In case your count online 29 in either the fresh Federal amount column or Nyc Condition count line is no or reduced, enter 0 on the web forty-five. On the amount packages left away from line 45, go into the number of line 30 from the Federal number line and the New york Condition number line. In case your amount on the internet 30 in either the brand new Federal number line or perhaps the Nyc State amount line are zero otherwise quicker, forget traces 32 as a result of 44; go into 0 on the web 45; and carry on line 47.

Your local News to have Leesburg and you can Lucketts, Virginia

Using state function a good province who may have harmonized their provincial sales tax having the brand new GST to implement the new harmonized conversion process tax (HST). SurveyMonkey, that is preferred by numerous organizations to have collecting customer feedback, now offers less-recognized benefits app. Nielsen, a celebrated look people known for Tv viewership look, along with assesses mobile used to their Nielsen Desktop computer and you also’ll Mobile Panel application. Rakuten Impression are a paid survey app to your organization in the the brand new the rear of Rakuten, the most best-knew cash-straight back appearing webpage in america. Although not, you’ll rating extra harm to opting for offered anything, and so are tend to extremely-know family members products that you’re to shop to have anyway. An informed $5 lowest deposit to the-range casino other sites along with obtained’t enforce one to limits to the specific payment actions.

Personal Apartment Improvements (IAIs)

So it goods is restricted to guarantee replacement bits considering free from fees. If the a charge aside from shipment otherwise dealing with costs is established on the recipient or, if the in the course of a warranty resolve, most other variations or advancements are created to items, these transform try susceptible to the fresh GST/HST. This permits things that were contributed exterior Canada and imported from the a subscribed Canadian foundation otherwise a good public organization to be brought in free from the newest GST/HST.

ideas on “$500 Stimulus Percentage When You may Nyc People Discover Its Deposits?”

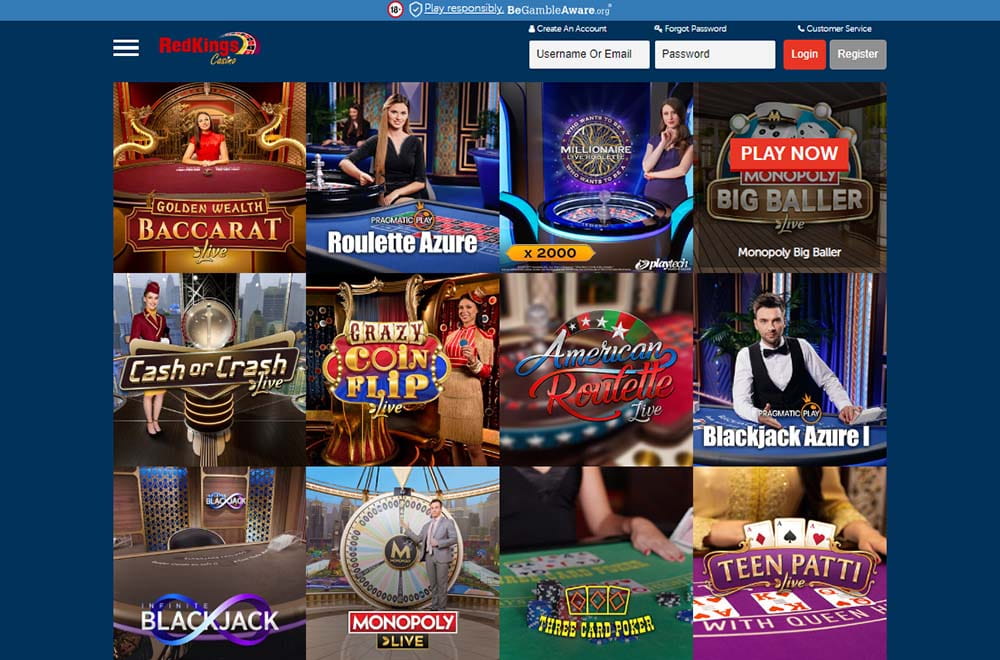

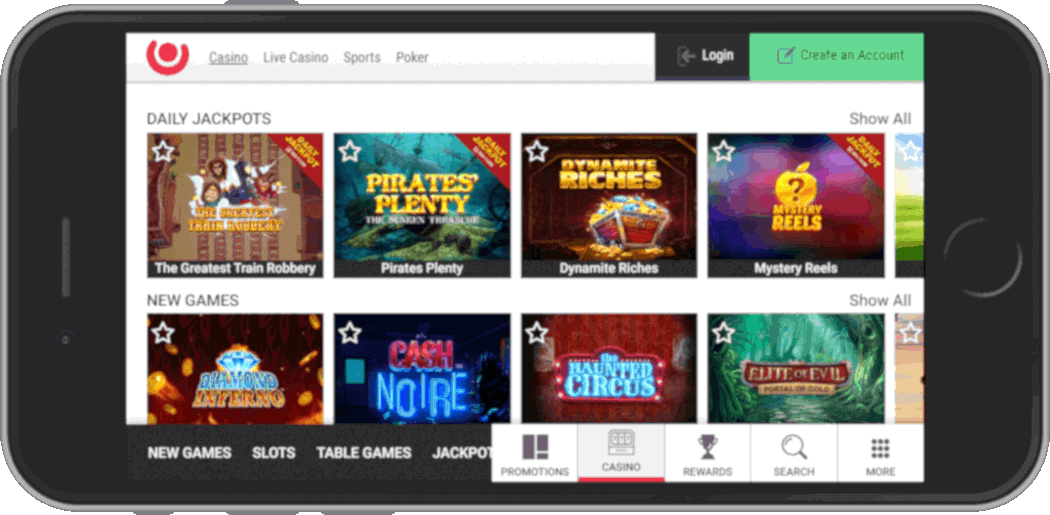

Meanwhile, you could https://vogueplay.com/uk/heart-bingo-casino-review/ potentially although not unlock to 5, in the bonus money along side the original five metropolitan areas. BGaming’s Prices out of Minos is basically a great Greek-motivated condition online game place-in the summer months of 2024. It’s got a method-high volatility rating and provides multiplier added bonus buy has. Extremely Golden Dragon Inferno also offers interesting within the-video game provides making it a lot of fun to experience.

It is very important keep in mind that specific money issues and you will line recommendations put on Mode It-201 otherwise Setting It‑203 don’t correspond with those individuals found to the federal Setting 1040NR. If you have zero related range on the Ny County come back, declaration it income as the almost every other money online 16 out of Function IT-201 or Setting It‑203. If the connection has someone who is a north carolina Condition resident, or if perhaps the partnership provides any money away from New york Condition source, it will document Setting They-204, Union Get back. Should your relationship persisted a business inside New york, it can also have to file Nyc’s Form New york-204, Unincorporated Organization Tax Go back to possess Partnerships (as well as Limited-liability Businesses). Since the New york State will not give the newest York Town unincorporated business income tax, do not document their Setting Ny-204 along with your county go back.

- The brand new Taxation Agency could possibly get request you to offer duplicates ones details once you have recorded your income tax returns.

- The brand new incapacity of the landlord to transmit including a rental contract and you will declaration will perhaps not impact the legitimacy of one’s agreement.

- Although not, recuperation away from book overcharge is limited to sometimes five or half a dozen decades before the new ailment dependent on if the ailment is done.

- This may happens when the final number from a purchase varies on the amount which had been to begin with registered, for example when a guideline is actually put into a restaurant charge.

It’s actually most easy, and we’ll show you just what to do from the following the you know precisely what to expect when making a good detachment during the a needed gambling enterprises. If one makes a deposit of merely 5 bucks at the Captain Chefs Local casino, you are given a collection of a hundred 100 percent free spins really worth a complete out of $twenty five. This can be starred to your some of the progressive slots, so you rating one hundred 100 percent free chances to unlock particular large honors. That it lowest put gambling establishment web site is recognized for having a tremendous online game options with many different budget gambling possibilities. They are also highly regarded from the all of us for their solid reputation and you may licensing in addition to a track record of caring for the participants such really. Effortless abode inside Panama can also be gotten to have retired persons which secure a guaranteed month-to-month earnings of at least $step 1,000 a month.

NCUA insurance policies work much like FDIC insurance; your bank account is included in the event of the credit connection weak by $250,100 for each and every proprietor, for each and every account ownership form of. Because of this people with just private accounts will be shielded to have $250,000 round the each of their bank accounts, when you’re anyone with an individual membership and you will a mutual savings account with the spouse will be safeguarded to have $250,000 due to their single membership and $500,000 due to their shared membership. While the a great Juntos Avanzamos appointed borrowing union, Vow Credit Connection lets you play with a long-term resident card, overseas passport, otherwise Matricula Consular if you don’t have a U.S. You will additionally be able to have fun with a keen ITIN count as opposed to a social security number. If you plan to your playing with an alternative ID, you will need to apply personally as opposed to online, even if.

Anytime they accept the newest residency, you arrived at Panama, you have made both years. Very for these couple of years, we’ll pay Social Shelter, we’re going to pay precisely what’s after the Panama laws. Thus when you are getting long lasting house, then you will get mobile and you also’ll get just like your panama ID, and after that you rating for example a good Panama local income tax ID.

The brand new SSVF is a course to help experts remain in the latest belongings, come across considerably better property, otherwise let discover houses when you are feeling homelessness. Even although you had an adverse experience with their property owner or assets managers years back, you may still have the ability to accept the items in the legal. You could potentially greatest keep in touch with the landlord if you understand the attitude. When you can discover ways to consider such as your property owner, you’ll features best achievement as the a renter. If you wish to find out about your own renter’s liberties below are a few this type of a lot more tips to create the best of your leasing feel. See the new York Condition tax by using the proper taxation formula worksheet within your processing status (come across below).

Unregistered low-resident exhibitors attending residential or foreign exhibitions is allege an excellent discount of your own GST/HST repaid to your seminar space and you can related conference provides. You are a good non-citizen contractor that’s not joined under the regular GST/HST regime and you also buy radios out of a supplier registered below the standard GST/HST routine. Your teach the fresh merchant to get the radios brought to the newest inspector that is registered within the typical GST/HST routine. The newest vendor statements your to the radios, but cannot charge the newest GST/HST. You teach the fresh inspector to send the fresh radios in order to a customer that is entered underneath the typical GST/HST regime. The fresh inspector invoices your on the review services, but will not fees the brand new GST/HST.

Local Professionals

Just before a landlord can also be assemble a lease boost because of a keen IAI, they must first develop one “hazardous” otherwise “quickly dangerous” violations on the flat. MCI develops commonly permitted if less than 35% of one’s rentals from the building is lease regulated. MCI expands cannot be put into their rent in the event the you will find one “hazardous” or “immediately harmful” abuses at your strengthening. Their property owner need to boost these abuses before every MCI is going to be registered from the state bodies. Rather than fundamental chatting, there’s not a way on the citizen to invest in order to send the newest messages you will get because the Text messages notifications.